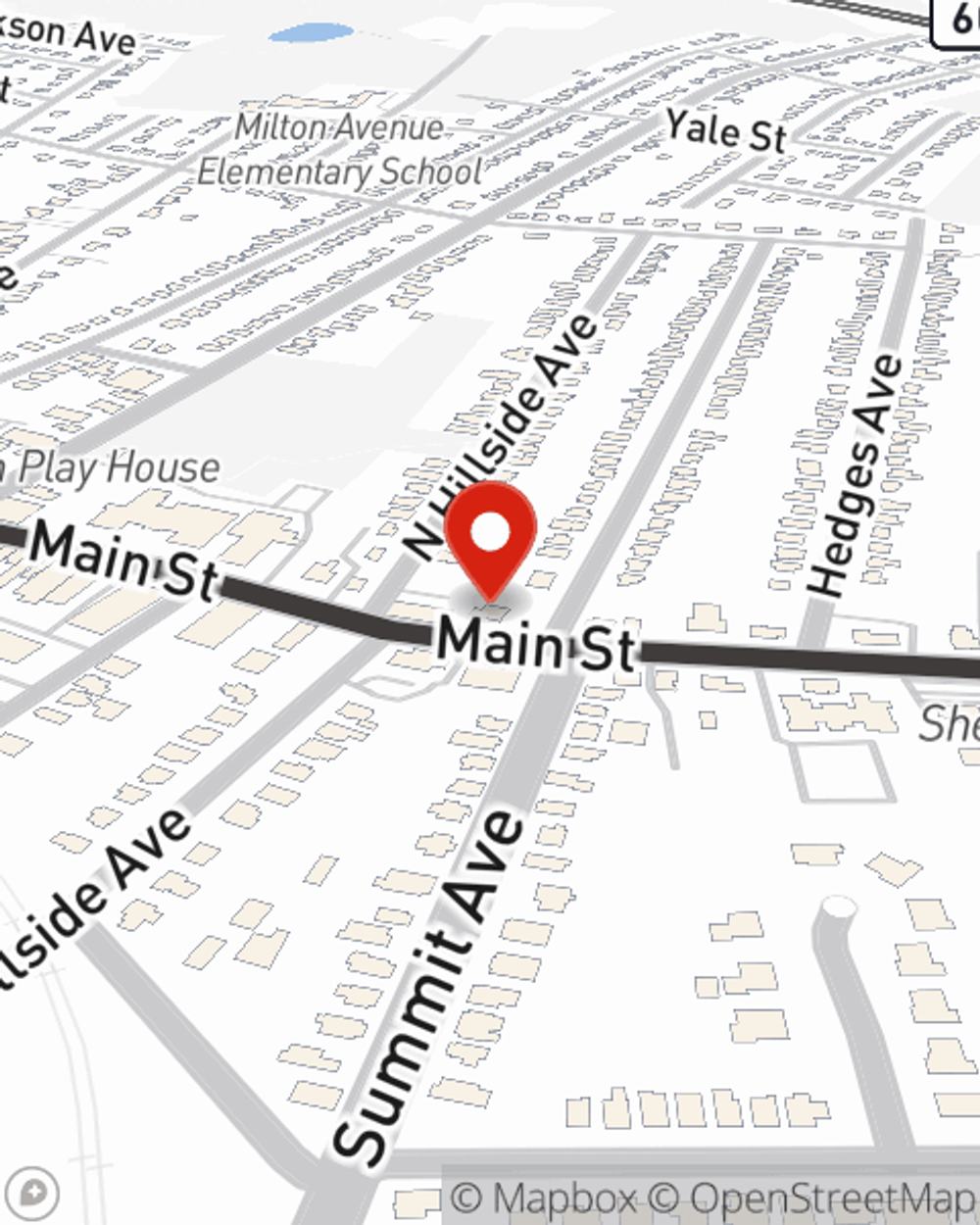

Business Insurance in and around Chatham

One of the top small business insurance companies in Chatham, and beyond.

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent Chip Ott, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of the top small business insurance companies in Chatham, and beyond.

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your pay, but also helps with regular payroll overhead. You can also include liability, which is critical coverage protecting you in the event of a claim or judgment against you by a consumer.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Chip Ott's team today to discover your options.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Chip Ott

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.